Do options in Hong Kong lose value closer to expiration?

As with any investment, the value of options can fluctuate, especially in the days and weeks leading up to expiration. While several factors can affect the value of options, one of the most important is time decay.

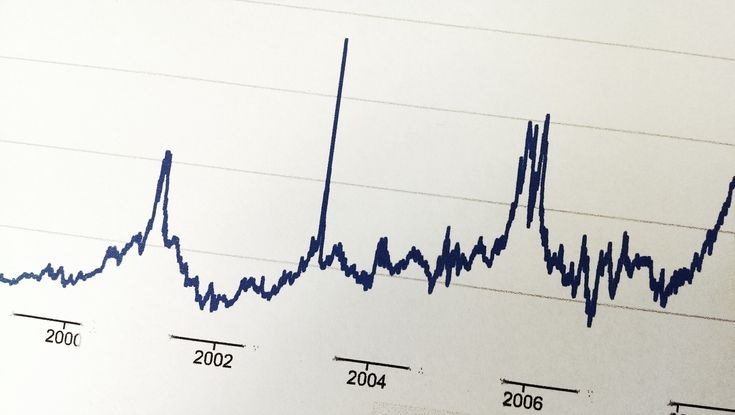

Time decay is the process by which the time value of an option declines as expiration approaches. The farther the expiration is, the more time there is for the underlying asset to move in the desired direction and generate a profit. Therefore, options lose value as they approach expiration.

However, it is not always the case, as other factors such as changes in volatility or the underlying asset price can offset time decay, which occurs at differing rates. Nevertheless, it is vital to know the potential for time decay when trading options in Hong Kong.

How to avoid time decay

Sell options

If you have an option about expiring, one way to avoid the effects of time decay is to sell it, which will lock in any profits you have made and prevent further losses. Of course, you will also forgo any potential profits if the underlying asset moves in the desired direction after selling.

Buy farther out-of-the-money options

Another way to avoid time decay is to buy options farther out of the money. These options will have less time value than nearer-term options and, therefore, less affected by time decay. Of course, this also means that they will be less likely to generate a profit, so you should only use this strategy if you are very confident in your forecast.

Use a spread

A third way to avoid time decay is to use a spread. A spread is an options strategy that involves buying and selling two different options on the same underlying asset. The most common type of spread is a Bull Call Spread, which involves buying a call option with a lower strike price and selling a call option with a higher strike price. This strategy can help you profit from a rising market while limiting your downside risk.

Sell at-the-money options

Another way to avoid time decay is to sell at-the-money options. At-the-money options have the most time value, so they are the most affected by time decay. By selling at-the-money options, you can offset the effects of time decay on your other positions. Of course, this strategy also risks unlimited losses if the underlying asset moves sharply in an undesired direction.

Use a long-term option

A final way to avoid time decay is to use a long-term option. Long-term options have more time until expiration and are less affected by time decay. You can use this strategy to hedge against shorter-term positions more vulnerable to time decay. Time decay is most rapid in the immediate run-up to option expiry, tending to start slowly.

How to trade options in Hong Kong

Choose a broker

The first step in Hong Kong’s trading options is choosing a broker. Many brokers offer options trading, so comparing their fees and services is essential before deciding.

Open an account

Once you have chosen a broker, you must open an account. This process will vary depending on the broker, but you will typically need to provide personal information and fund your account with cash or securities.

Determine your strategy

Before you begin trading options, you must know your goals and what strategy you will use to achieve them. There are various options trading strategies, so it is essential to research and choose the right one for you.

Place your trade

Once you have chosen a strategy, you must place your trade. Depending on your broker, you can do this online or over the phone. When placing a trade, you will need to provide the following information:

- The underlying asset

- The type of option (call or put)

- The strike price

- The expiration date

- The number of contracts

Monitor your position

After placing your trade, it is crucial to monitor your position and ensure that it is performing as expected. You may need to adjust your trade if the underlying asset moves unexpectedly. In addition, keep an eye on the clock as options contracts have a limited lifespan and will expire at some point. Click here to check the available options on Saxo’s website.