What Is Payroll Deduction?

Did you know that most organizations will have a salary-to-revenue ratio of between 15{d76f1c19516befd0d02dd7628c4f02994b77c2f36ca1cda12e5887cc42cc72f7} and 30{d76f1c19516befd0d02dd7628c4f02994b77c2f36ca1cda12e5887cc42cc72f7}?

As challenging as starting your own business, it’s also essential to ensure you’re still getting all the basics right, from bookkeeping to knowing your profit margins.

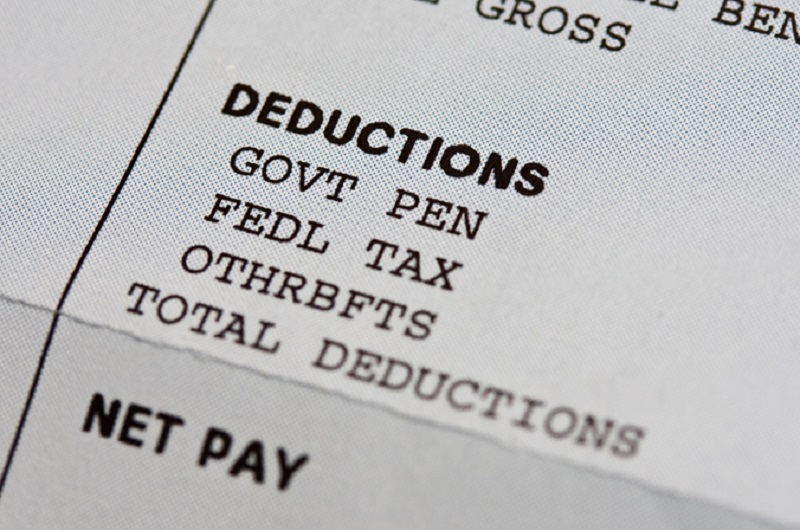

What is payroll deduction? Payroll deduction is a payroll method of withholding taxes and wages that employees are entitled to. Knowing what this is and what it means for your workers, your business, and you are vital.

Keep reading to find out all you need to know about payroll deduction.

What Is Payroll Deduction?

A payroll deduction is a deduction that is made from an employee’s wages. This deduction is typically made for taxes, insurance, or retirement contributions. Payroll deductions can also be made for other items, such as charitable donations or union dues.

A payroll deduction is an amount of money taken out of a Payroll deduction that is typically taken out before taxes are calculated, which means that they lower the amount of taxes an employee owes. You can also use payroll deduction to pay for childcare expenses, union dues, and other items agreed upon by the employer and employee.

Purpose of Payroll Deduction

A payroll deduction is an amount of money automatically deducted from an employee’s wages and paid to a designated recipient. The purpose of a payroll deduction is to withhold money from an employee’s paycheck for taxes, retirement savings, or other purposes.

Payroll deductions are typically deducted from an employee’s gross pay; the total amount of money earned before taxes and other deductions are withheld. If you are looking for a payroll deduction guide or how it works, read more here.

Benefits of Payroll Deduction

One of the benefits of payroll deduction is that it can help you save money on your taxes. When you have money withheld from your paycheck for taxes, you can have a lower tax bill at the end of the year. It can help you keep more of your hard-earned money.

Another benefit of payroll deduction is that it can help you save for retirement. When you have money deducted from your paycheck for retirement, you can make sure that you have money set aside for your later years. It can help you live a comfortable retirement.

Disadvantages of Payroll Deduction

One of the disadvantages of payroll deduction is that it can lead to a lot of wasted time and money. When employees have to deduct money from their paychecks for taxes, retirement, or other deductions, they may not have enough money to cover their basic needs. It can lead to financial problems and even cause some employees to quit.

Common Payroll Deductions

Payroll deduction is when an employer withholds money from an employee’s paycheck each pay period. Federal and state income taxes, Medicare, Social Security, and health insurance premiums are common deductions.

Understanding Payroll Deductions

What is payroll deduction? Payroll deduction is deducting money from an employee’s wages to pay for taxes, insurance premiums, or other designated items. A payroll deduction may be the right choice if you’re looking for a convenient way to spend your taxes and insurance premiums.

Check out our other sections for more informative content.