Business Paperwork: Retention Guidelines for Small Businesses

Thirty million SMEs exist in the United States. Starting a small business is a path to self-sufficiency, but not all SMEs are successful, often because of poor records management and so on.

Poor company management and a lack of organization can cause overlooked opportunities, extended costs, and in a few cases, even legal trouble from tax filings.

This is why having some small business paperwork retention tips handy is essential. Read on for some advice on organizing your business paperwork in the most efficient way possible.

When to Keep Business Records

According to the Small Business Administration, small businesses should keep business papers for three to seven years. This varies based on the type of records. For example, you should keep employment records for at least three years and tax records for at least seven years.

What Records to Keep

Small businesses should generally keep most business records for at least three years. After three years, you can shred most records (including old receipts, financial statements, and expired contracts). There are, however, a few exceptions:

- Expense records. Keep receipts until you file your taxes for the year.

- Income records. Keep records of all income until you file your taxes for the year.

- Asset records. Keep records of all major purchases (over $500) until you sell or dispose of the asset.

- Liability records. Keep records of all loans and credit lines until they are paid off.

- Employee records. Keep records of all employee applications, W-2 forms, and performance reviews until the employee leaves your company.

How Long to Keep Records

The IRS recommends that small businesses keep three years of business paperwork. This includes receipts, invoices, tax returns, and bank statements.

After three years, businesses can shred old records. Keeping good records helps companies track their income and expenses, prepare for tax time, and make sound financial decisions.

How to Store Records

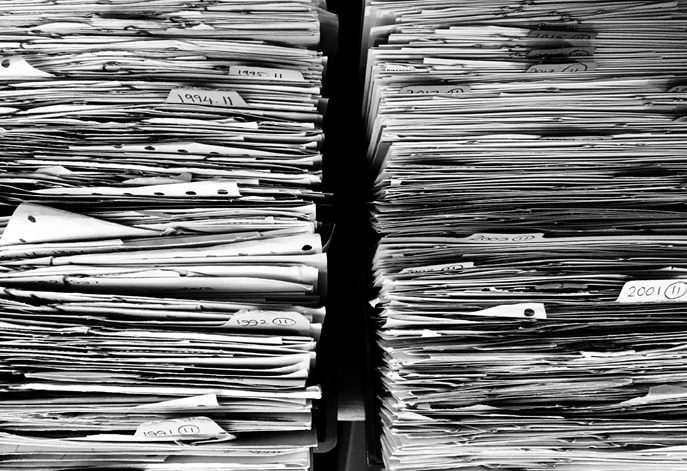

There are a few different routes you can take to store your business documents. You can scan and save digital copies, keep the physical originals in a filing cabinet or box, or both. If you decide to go the digital route, you’ll need to determine how long you’ll need to keep the files and set up a system for periodically backing them up. You can use these free invoice templates to create online copies of invoices.

If you go the physical route, you’ll need to find a place to keep them safe and protect them from damage. No matter which way you choose, set up a system for quickly locating and retrieving records when you need them.

Establishing Proper Business Paperwork Retention

Small businesses need to establish consistent guidelines for business paperwork retention. This will help keep the office organized and free from cluttered, outdated files. Companies should also create a system for destroying old documents no longer needed.

These steps will help to keep your business running smoothly and efficiently.

That’s why it’s so important to start with proper business documentation every step of the way. For more business-related guidelines, check out the other blogs on our site!